Condo Insurance in and around Austin

Condo unitowners of Austin, State Farm has you covered.

Condo insurance that helps you check all the boxes

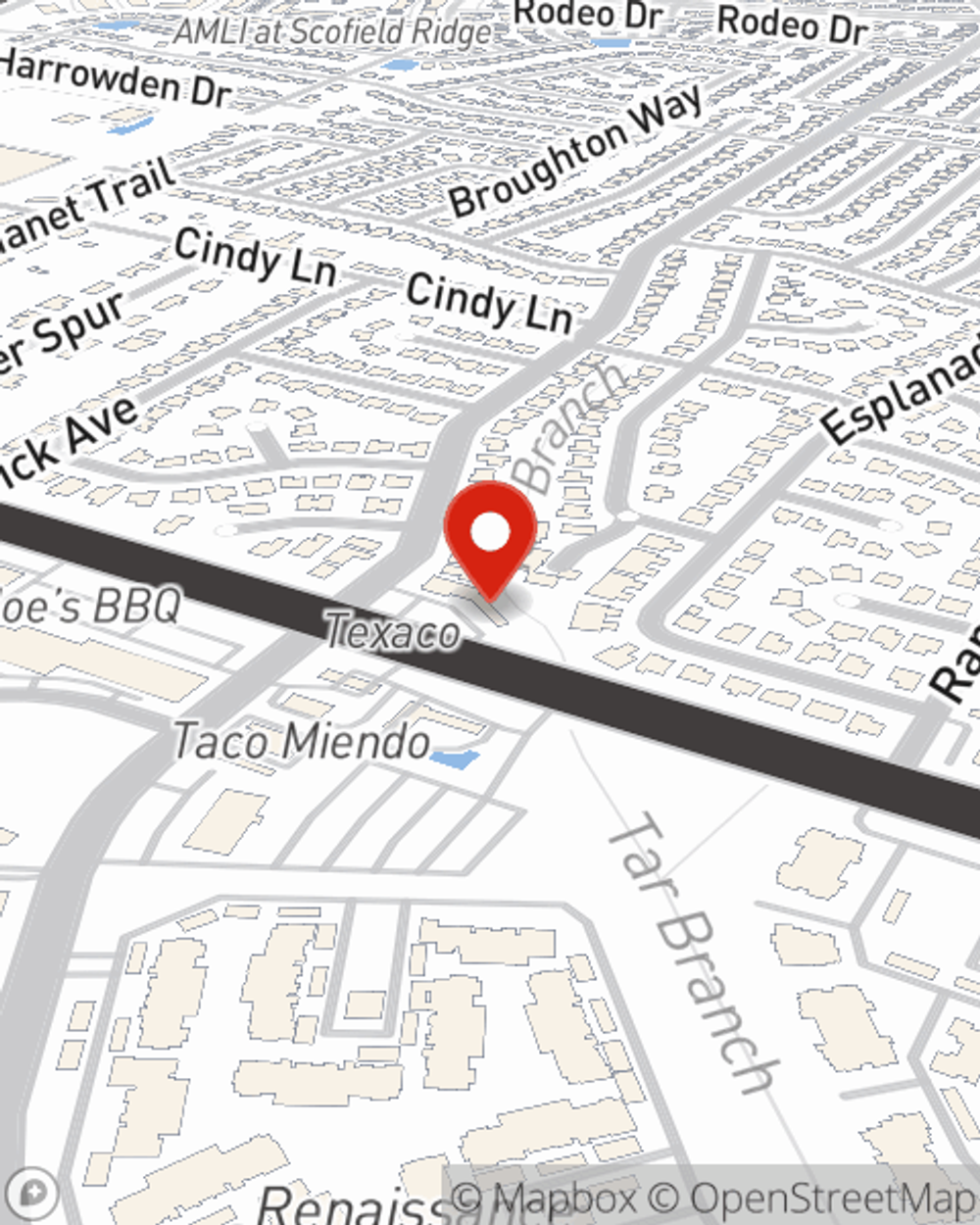

- Austin

- Cedar Park

- Leander

- Pflugerville

- Hutto

- Round Rock

- Manor

- Georgetown

- Lakeway

- Taylor

- Liberty Hill

- Houston

- Dallas

- Fort Worth

- Dripping Springs

- Bastrop

- San Antonio

- Marble Falls

- San Marcos

- Waco

- Temple

- College Station

- Bryan

- San Angelo

Condo Sweet Condo Starts With State Farm

When you think of "home", your condo is first to come to mind. That's your sanctuary, where you have made and are still making memories with family and friends. It doesn't matter what you're doing - resting, playing, catching your breath - your condo is your space.

Condo unitowners of Austin, State Farm has you covered.

Condo insurance that helps you check all the boxes

Agent Mac Freeman, At Your Service

That’s why you need State Farm Condo Unitowners Insurance. Agent Mac Freeman can roll out the welcome mat to help create a policy for your particular situation. You’ll feel right at home with Agent Mac Freeman, with a no-nonsense experience to get dependable coverage for your condo unitowners insurance needs. Customizable care and service like this is what sets State Farm apart from the rest. Agent Mac Freeman can help you file your claim whenever the unforeseen lands on your doorstep. Home can be a sweet place to be with State Farm Condominium Unitowners Insurance.

Don’t let worries about your condo keep you up at night! Get in touch with State Farm Agent Mac Freeman today and explore how you can meet your needs with State Farm Condominium Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Mac at (512) 835-7905 or visit our FAQ page.

Simple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Mac Freeman

State Farm® Insurance AgentSimple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.